2023 Insulation Tax Credit Encourages Residential Homeowners to Implement Air Leakage Solutions in Residential Attic Spaces

As the surge for energy conservation increases, it is essential for today’s society to implement energy-efficient measures into our current and future communities. One of the major components in low energy conservation measures is attic spaces in residential homes. Attic spaces, where the integrity of the insulation is low, the overall level of energy efficiency is minimal.

The Importance of Energy-Efficient Residential Homes

According to the Department of Energy, a residential home loses at least 50% of its heating and cooling – the culprit: openings caused by recessed can light fixtures and LED downlights. One single uncovered and non-airtight recessed light fixture can allow up to 2.5 million cubic feet of air pass through it in 12 months, which is equivalent to wasting 1 million BTUs of energy loss per fixture.

In addition to the low levels of energy efficiency, homeowners may be experiencing the inconvenience of a drafty home and expensive energy bills, due to the air leakage from these in-ceiling light fixtures.

25C Insulation Tax Credit

In efforts to encourage taxpaying residential homeowners to implement preventive, energy-efficient solutions, the 25C Tax Credit was introduced. The 2023 Energy Efficient Home Improvement (25C) Credit offers a significant tax credit, up to $1,200, when adding insulation and air sealing solutions to an individual’s attic space. The tax credit is equal to 30% (up to $1,200) of the amount paid by the homeowner for qualifying energy-efficient improvements. These renovations include insulation and air sealing materials and do not include labor/installation costs. Calculate your potential savings by visiting, ICCA’s 25C Tax Credit Calculator.

- To qualify for this credit, you must be:

• A taxpaying homeowner, where the home is owned and used by said taxpayer as their principal residence. The tax credit is not applicable to a newly constructed home.

• Use qualifying insulation and air sealing products, which includes insulation materials that reduce heat loss or heat gain from a living space qualify. This includes insulation, air sealants, vapor and air retarders, recessed light covers, and attic hatch covers.

For additional information about the 25C Insulation Tax Credit, please visit https://www.insulate.org/25ctaxcredcalc/.

Tenmat Recessed Light Protection Covers

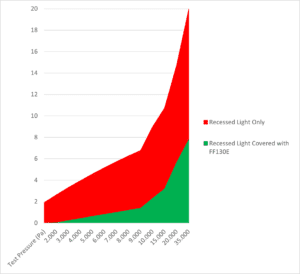

Tenmat, a leading advanced materials manufacturer, has designed a line of innovative insulation protection products and solutions designed to reduce energy loss through light fixtures. Due to the improved airtightness and insulation, TENMAT users experience significant energy savings. TENMAT Recessed Light Covers allow the insulation to be continuous and uninterrupted over the whole area of the ceiling, therefore saving energy and carbon emissions. Airtightness tests conducted by Chiltern Dynamics confirmed that TENMAT covers reduce air leakage up to 94% (Figure 1), which translates into annual energy savings of over $30 per fixture.

With its air-sealing capabilities, Tenmat’s Recessed Light Protection Enclosures qualify for the 25C Tax Credit. These solutions have been formulated to be compatible with recessed can lights and LED downlights, regardless of model or manufacturer. In addition to its fixture versatility, these solutions are composed of a lightweight, flexible material – allowing for easy installation for homeowners or insulation contractors.

In conjunction with its energy-efficiency capabilities, Tenmat’s Light Protection Covers protect hot recessed lights from touching insulation. Our solutions are compatible with cellulose, foam, fiberglass, etc., which allows for the insulation to be protected from recessed fixtures and provide a continuous layer of insulation.

For quick DIY projects, homeowners are able to purchase these solutions at their local hardware store or if you are conducting large-scale insulation renovations, local insulation contractors have access to Tenmat’s Recessed Light Covers. If you are interested in learning more about these revolutionary, cost-saving solutions, please click here.

Sources:

ICCA (Insulation Contractors Association of America), https://www.insulate.org/25ctaxcredcalc/